To generate outsize returns over 3 -5 years, through a portfolio which may predominantly invests in large cap stocks and selectively in quality mid cap, small cap and micro-cap stocks.

Portfolio will invest in listed equity and equity related instruments. The portfolio can have some exposure to debt instruments including Money Market Instruments, units of mutual fund, fixed deposits, or any other securities as may be specified by SEBI from time to time.

Listed equity and equity related instruments will be selected basis the in-house proprietary research carried out by the portfolio management team, in accordance with investment objective of the Portfolio. Debt instruments will be typically used for temporary parking of Funds pending deployment in market wherein liquidity and safety will be the primary basis for selection.

Equity & equity related instruments: 70%-100% | Debt Instruments: 0-30%

BSE 200; The Portfolio Manager would endeavour to generate capital appreciation by investing in a portfolio that may primarily invest in large cap & selectively in midcap, small cap & microcap stocks. Hence, benchmark of BSE 200 index will be an appropriate choice to compare the performance.

Ideal investment horizon for any equity investment should be long term in nature for compounding to work for the Client. However, the indicative investment horizon for the portfolio should be at least 3 years.

| Security | % Assets | HoldingPerformanceId | ProductName |

|---|---|---|---|

1. What is Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) is an investment portfolio in stocks, fixed income, debt, cash, structured products and other individual securities, managed by a professional money manager, that can potentially be tailored to meet specific investment objectives.

When you invest in PMS, you own individual securities unlike a mutual fund investor, who owns units of the entire fund. You have the freedom and flexibility to tailor your portfolio to address personal preferences and financial goals. Although portfolio managers may oversee hundreds of portfolios, your account may be unique.

Investment Management Solutions in PMS, can be provided in the following ways:

- Discretionary

- Non Discretionary

- Advisory

Discretionary: Under these services, the choice as well as the timings of the investment decisions rest solely with the Portfolio Manager.

Non Discretionary: Under these services, the portfolio manager only suggests the investment ideas. The choice as well as the timings of the investment decisions rest solely with the Investor.

However the execution of trade is done by the portfolio manager.

Advisory: Under these services, the portfolio manager only suggests the investment ideas.

The choice as well as the execution of the investment decisions rest solely with the Investor.

Note: In India majority of PMS providers offer Discretionary Services.

2. Who can offer PMS?

PMS can be offered only by entities having specific SEBI registration for rendering portfolio management services. Currently in India. PMS is offered primarily by asset management companies (AMCs) and brokerage houses.

4. Does one necessarily have to invest in cash to open a PMS account?

Apart from cash, the client can also hand over an existing portfolio of stocks, bonds or mutual funds to a PMS that could be revamped to suit his profile.However the portfolio manager may at his own sole discretion sell the said existing securities in favour of fresh investments.

5. What is the tax liability for the PMS investor?

The portfolio manager is a trustee acting in a fiduciary capacity on behalf of the investor. Therefore, the tax liability for a PMS investor would remain the same as if the investor is accessing the capital market directly. However the investor should consult his tax advisor for the same. The portfolio manager ideally provides audited statement of accounts at the end of the financial year to aid the investor in assessing his/ her tax liabilities.

6. What are the benefits of PMS?

a. Professional Management - The service provides professional management of portfolios with the

objective of delivering consistent long-term performance while controlling risk.

b. Continuous Monitoring - It is important to recognise that portfolios need to be constantly monitored and

periodic changes made to optimise the results.

c. Risk Control - A research team responsible for establishing the client's investment strategy and providing

the PMS provider real time information to support it, backs any firm's portfolio managers.

d. Hassle Free Operation - Portfolio Management Service provider gives the client a customised service.

The company takes care of all the administrative aspects of the client's portfolio with a periodic reporting

(usually daily) on the overall status of the portfolio and performance.

e. Flexibility - The Portfolio Manager has fair amount of flexibility in terms of holding cash (can go up to

100% also depending on the market conditions). He can create a reasonable concentration in the investor

portfolios by investing disproportionate amounts in favour of compelling opportunities.

f. Transparency - PMS provide comprehensive communications and performance reporting. Investors will get

regular statements and updates from the firm. Web-enabled access will ensure that client is just a click

away from all information relating to his investment. Your account statements will give you a complete

picture of which individual securities you hold, as well as the number of shares you own. It will also

usually provide:

- the current value of the securities you own; - the cost basis of each security;

- details of account activity (such as purchases, sales and dividends paid out or reinvested);

- your portfolio's asset allocation;

- your portfolio's performance in comparison to a benchmark;

- market commentary from your Portfolio Manager

g. Customised Advice - PMS give select clients the benefit of tailor made investment advice designed to

achieve his financial objectives. It can be structured to automatically exclude investments you may own

in another account or investments you would prefer not to own. For example, if you are a long-term employee

in a company and you have acquired concentrated stock positions over the years and have become over exposed

to few company's stock, a separately managed account provides you with the ability to exclude that stock from

your portfolio.

h. Personalised Approach - Some Portfolio Managers may provide a personal investment management service to

achieve the client's investment objective. In PMS, you may gain direct personalised access to the professional

money managers who actively manage your portfolio. This interaction may come in various different ways

including in-person meetings, conference calls, written commentary, etc with the fund management team.

7. What can you expect from PMS?

When one has entrusted his money to a PMS, one can expect:

Handholding from his portfolio manager than he has been accustomed to from his mutual fund.

One can expect to have a relationship manager/ financial advisor through whom he can interact with

the fund manager at any time of his choice. One can also expect frequent (maybe monthly) interaction

with the portfolio manager to discuss any concerns that he might have. To be updated on any major

changes in asset allocation or in the investment strategy relating to his portfolio. All administrative

matters, including operating a bank account and dealing with settlement and depository transactions,

will be handled by the PMS.

On handing over one's money, he will receive a user-ID and password from the PMS, which will grant him

online access to his portfolio details. He can use these to check back on his portfolio as often as he likes.

Keeping track of capital gains (and losses) for the taxman can be a depressing chore, when one has furiously

churned his investments through the year. Opting for PMS will free him of this chore, as a detailed statement

of the transactions on his portfolio for tax purposes comes as a part of the package.

8. What one pays for PMS?

When one has entrusted his money to a PMS, one can expect:

Most Portfolio Managers allow one to choose between a fixed and a performance-linked management fee or a

combination. If one opts for the fixed fee, he may pay between 2.50-3.50 per cent of portfolio value; this

is usually calculated on a weighted average basis. This fee is apart from the actual expenses like custodian

expenses, audit fee, brokerage on transactions etc, which may be charged on actuals. The structure for the

performance-linked fee differs across players; usually, apart from a performance-linked fee usually it may

include a flat fee.

The portfolio manager also gets to share a percentage of your profit - usually 15-20 percent - earned over and

above a threshold level, which may range between 8 per cent and 15 per cent.

Apart from management fees, separate charges will be levied towards brokerage, custodial services and towards

meeting tax payments. Usually the fixed fee component is charged on a monthly basis and the variable component

is charged on a yearly basis.When one opts for a performance-based fee, the profits are reckoned usually on

the basis of "high watermarking". That is, one pays the fee only on the positive returns on his portfolio.

For instance, if one invests Rs. 100 in a PMS and its value appreciates to Rs. 150 at the end of the year,

he pays a fee on the profit of Rs. 50. Subsequently, a fee will be levied only on gains over and above the

Rs. 150 mark. If the value of his portfolio slumps to Rs. 70, and climbs back to Rs. 110, the Rs. 40 you

earn will not be reckoned as profit. You will again be charged a fee only if the value of your portfolio

recovers to over Rs. 150, the previous "high watermark."

9. Portfolio Management Services and Mutual Funds: The Differences

Features |

PMS |

Mutual Fund |

Management |

Provide ongoing, personalized access to professional money management services |

Provide access to professional money management services |

Customization |

Portfolio can be tailored to address each investor's specific needs |

Portfolio structured to meet the fund's stated investment objectives |

Management |

Provide ongoing, personalized access to professional money management services |

Provide access to professional money management services |

Ownership |

Investors directly own the individual securities in their portfolio, allowing for tax management flexibility |

Shareholders own shares of the fund and cannot influence buy and sell decisions or control their exposure to incurring tax liabilities |

Liquidity |

Although managers may hold cash, they are not required to hold cash to meet redemptions |

Mutual funds generally hold some cash to meet redemptions |

Minimums |

Significantly higher minimum investments than mutual funds. Generally, minimum ranges from:

|

Provide ongoing, personalized access to professional money management services |

Flexibility |

Generally more flexible than mutual funds. The Portfolio Manager may move to 100% cash if required. |

Comparatively less flexible |

10 . Role of the Financial Advisor

The Financial Advisor should guide the investor through an ongoing consulting process designed to lead him towards his investing goals and keep his investment strategy on track. This process may include the following:

- Setting Goals and Guidelines: The investor along with the Financial Advisor can work together to

identify his financial goals and expectations, which can be translated into a long-term investment plan.

- Determining Asset Allocation: Based on the investor objectives, the Financial Advisor may suggest an asset

allocation divided among stocks, fixed income, debt, cash, structured products and other investments and also

determine which investment vehicles are most appropriate for the investor. Having a mix of broad asset categories

is an important factor in achieving the investor's investment objectives.

- Selecting Investment Managers and Investment Vehicles: After determining asset allocation, the Financial

Advisor may recommend specific portfolio managers who manage assets in a particular style, such as large cap

growth, for example. The Financial Advisor's choice of managers is generally based on the manager's investment

style and performance history, the professional relationship he or she has developed with the manager and the

manager's firm, and a number of other criteria.

- Managing and Monitoring Investor Accounts: Investors may receive periodic statements detailing their account's

holdings and performance. The Financial Advisor may want to meet with the investor to explain the information

in these statements and evaluate the performance in light of his goals. If a change is needed, the Financial

Advisor can recommend adjustments to help meet investor objectives.

- Ongoing Personal Service:PMS service may include ongoing communication and frequent contact from the Financial Advisor, in addition to periodic reviews. Also the Financial Advisor may help you put investment performance in the proper perspective, and help you decide whether it may be appropriate to:

a) modify your expectations to reflect a changing market;

b) adjust your risk considerations; or

c) reallocate the assets in your portfolio.

11. Frequently Asked Questions

Q: What is Portfolio Management Services?

PMS is an investment portfolio of stocks, fixed income, debt, cash, structured products and other securities that is tailored to meet specific investment objectives.

Q: What are the benefits of PMS?

PMS can offer the following characteristics: inpidualised portfolios, professional management, richer canvas, flexibility, transparency, persification and asset allocation, among others.

Q: What types of investors own PMS accounts?

Each inpidual client has different needs that change over time. A Financial Advisor can help the investor decide whether portfolio management service is appropriate, based on his current financial situation, investment objectives, time horizon, risk tolerance and other factors.

Q: What investment strategies are available?

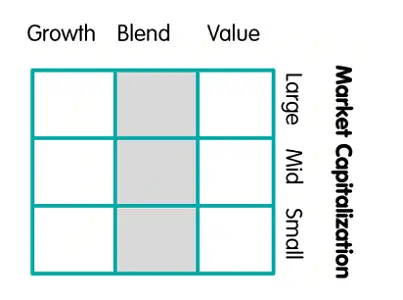

PMS is offered in a wide variety of asset classes and investment styles, including large cap, mid cap, small cap, multi cap, value and growth and international asset.

Q: What is the role of the Financial Advisor after a PMS account is opened?

The Financial Advisor helps the investor identify and select investment options, and continues to provide the services of a primary relationship manager. Financial Advisors take on a consultative role with the investor by helping the investor work with the portfolio management team to discuss and determine the appropriateness of the investor's current investment strategy. Financial Advisors also help in evaluating the investment performance of the investor.

Q: How does the investor stay updated on his portfolio's performance?

Regular communication from the portfolio management team is an essential tool in keeping the investor and the Financial Advisor informed. Among the tools that are usually provided: periodic performance reporting, monthly investment commentary, and online portfolio information.

Q: What is the difference between a PMS account and a mutual fund?

Unlike an investor in a mutual fund, portfolio managed account holders own the inpidual securities in their accounts. Although investment managers oversee hundreds of accounts, a PMS investor's account is "separate" from that of any other investor, which gives the investor the ability to direct the manager to customize the portfolio based on personal and financial needs and goals. For example, the investor may request that the portfolio include or exclude a particular security or sector, or that some holdings be sold to produce capital gains or losses.

Q: What if the investor has special requests?

PMS allow investors to impose reasonable stock, sector, or other preferences and restrictions on the management of their accounts. For example, if the investor owns his employer's stock in investment, the investor and the Financial Advisor may decide not to invest additional assets in the company.

Q: How much input does the investor have in the stocks that are chosen for his portfolio?

The Investor and the Financial Advisor will want to have an initial consultation to discuss specific objectives, risk tolerance, time horizon, and goals. Depending on the PMS account chosen, the investor may have the ability to impose reasonable investment restrictions on the management of his account. Some PMSs offer more flexibility than others, usually based on the amount invested.

Q: What are the minimum investment requirements for PMS accounts?

As per SEBI Regulation, the minimum investment requirements in PMS is Rs 50 lakhs.

Q: Are there risks associated with PMS investments?

Yes. All investments involve a certain amount of risk, including the possible erosion of the principal amount invested, which varies depending on the security selected. For example, investments in small and mid-sized companies tend to involve more risk than investments in larger companies.

Investments in securities are subject to market risks. There are no assurances or guarantees that the objectives of any of the Products will be achieved. The investments may not be suited to all categories of investors. The value of the Portfolios can go up or down depending on various market factors. Past performance of the Portfolio Manager does not indicate the future performance of the Products or any other future Products of the Portfolio Manager. Investors are not being offered any guaranteed or indicative returns through any of the Products. The names of the Products do not in any manner indicate their prospects or returns. The performance of the Products may be adversely affected by the performance of individual companies, changes in the market conditions, micro and macro factors and forces affecting capital markets in particular like interest rate risk, credit risk, liquidity risk and reinvestment risk. Derivative/future and options products are affected by various risks including but not limited to counter party risk, market risk, valuation risk, liquidity risk, basis risk and other risk. Besides the price of the underlying asset, the volatility, tenor and interest rates affect the pricing of derivatives. In the case of stock lending, risks relate to the defaults from counterparties with regard to securities lent and the corporate benefits accruing thereon, inadequacy of the collateral and settlement risks. The portfolio Manager is not responsible or liable for any loss resulting from the operations of the Products/ Portfolios. Each portfolio will be exposed to various risks depending on the investment objective, investment strategy and the asset allocation. Non-Diversified Portfolio tends to be more volatile than diversified portfolio. Please read the Disclosure Document before investing. Nippon Life India Asset Management Limited is registered with Securities & Exchange Board of India as a Portfolio Manager vide Registration Number PM/INP000007085 having registered and corporate office at 4th Floor, Tower A, Peninsula Business Park, Ganpatrao Kadam Marg, Lower Parel, Mumbai - 400013.

Terms and Conditions

GRIEVANCE REDRESSAL